Stable Currencies are Impractical and Undesirable

Posted by Daniel Larimer on .It seems that everyone wants a stable crypto currency. Recently Vitalik Buterin posted a blog about the “Search for a Stable Cryptocurrency” which prompted much discussion on the BitShares forums about his approach. Today I would like to put a nail in the coffin on the insanity of pursuing a stable currency, let alone a stable crypto-currency.

The Federal Reserve has as a mandate of “stable prices” and it is almost universally accepted that this is a good mandate. It is also widely accepted among many crypto-currency fans that the FED has failed at their mandate because of persistent rise in prices resulting in the dollar losing 99% of its purchasing power since the FED was founded in 1913. As a result people in the crypto currency space are attempting to provide an alternative currency that can achieve the FEDs mandate. The goal of price stability at its heart is the same as Price Fixing

and this is a well known economic fallacy that crypto-currencies should avoid.

What is a Price?

Every price is a ratio of value between two assets and not a property of any individual asset. The free market is a completely decentralized process for establishing the global consensus on the relative value of all goods and services. In an active market there isn’t a single price, but two prices: the price someone is willing to pay and the price someone is willing to sell at. The current consensus on the relative value of any good is somewhere between the bid and ask price.

It is generally accepted that all goods, services, stocks, bonds, and commodities are volatile. Since each of these items is half of every price, it is impossible to have price stability against any one item because the value of that item is constantly changing. When people think price stability they envision a currency that can purchase the same life style over many years: no more, no less. They usually envision a basket of commodities and a weighted average of prices. The idea is that if the price of one product goes up, that means the price of another product must go down in such a way that the average price remains unchanged.

The challenge becomes how should one define this weighted basket of commodities? Governments around the world are constantly changing how they calculate the basket and what items are included. They will do things like exclude food and energy along with stocks and real estate. John Williams maintains a website called “Shadow Government Statistics” dedicated to providing alternative measures of inflation that show inflation as 3x higher than what the government is currently reporting using the governments own standards from prior years. It doesn’t even include stocks and bonds whose value also changes with the currency.

The challenge becomes how should one define this weighted basket of commodities? Governments around the world are constantly changing how they calculate the basket and what items are included. They will do things like exclude food and energy along with stocks and real estate. John Williams maintains a website called “Shadow Government Statistics” dedicated to providing alternative measures of inflation that show inflation as 3x higher than what the government is currently reporting using the governments own standards from prior years. It doesn’t even include stocks and bonds whose value also changes with the currency.

Lets ignore the fact that we cannot even agree on a suitable standard for price stability. The fact remains that the value of any given basket of commodities, goods, and services will change over time as the population, climate, politics, war, and weather impact the growth or contraction of the economy. The idea that any currency could exist and maintain stable purchasing power through a nuclear war is insane. Even World War III by conventional means would decimate global production and cause the supply of goods and services to contract dramatically relative to any money supply. The economy would simply be unable to maintain the same standard of living for everyone.

Supply Stability

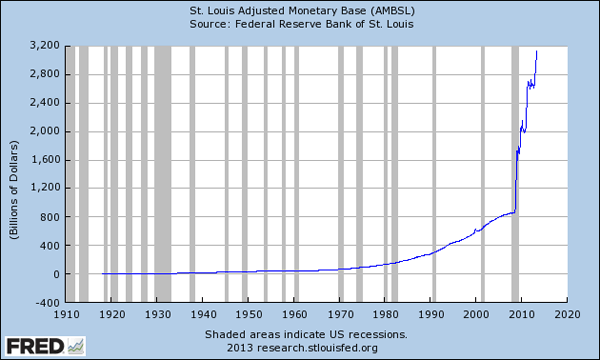

Austrian economists prefer to use monetary inflation rather than price inflation to have a more accurate picture of what is going on. From this point of view a 10% growth in the money supply relative to a static economy would result in a 10% rise in prices if the new money was distributed proportional to the old money. The moral problem that many of us have with the existing system is that this 10% increase in the money supply is not evenly distributed. Instead, it is directed at those closest to the banks who then direct the money into the stock market, real estate, and factories. Over time the impact of increased money supply results in higher prices for everyone, but initially those who got access to the money first could spend at the old prices. In effect, growing the money supply in a non-uniform manner results in unearned wealth transfer from the poor to the rich.

What does Price Stability really mean?

The goal of the FED Price Stability mandate is to mask the systematic theft of all increases in the production efficiency of the economy. Lets assume the FED managed to keep prices stable through their monetary policy with 0% price inflation over 20 years. Now lets assume that during this same 20 years the invention of the computer and Internet resulted in a 3x increase in efficiency and thus there are now 3x as much food, cars, phones, houses, etc. For the sake of this example we will assume the population is the same and everyone has the same amount of money in the bank. You would normally expect that everything would be 1/3 the price and that everyone would be able to afford 3x their prior life style. But because of FED intervention they have managed to also increase the money supply by 3x and distribute it to their friends. The end result is that some people get a 1000x increase in life style while everyone else stands still.

We can conclude from this that the mandate for price stability is a goal meant to mislead the general public and mask theft from the lower and middle classes on a massive scale even at 0% price inflation. It would be ridiculous to bring this same mandate to crypto currencies which aim to free us from monetary enslavement.

Who gets the New Money?

Vitalik recognized the problem of distributing new issuance in his blog where he outlines several approaches:

- Miners get the new coins.

- BitAsset approach used by BitShares

- SchellingDollar approach.

- Seignorage Shares

It was easy to dismiss the mining approach because it has no way to reduce supply and still results in a wealth transfer to miners which waste most of it in the mining process itself. I will skip the BitAsset approach and simply point you to an entire post about our Market Pegged assets. This leaves only the SchellingDollar and Seignorage Shares approaches.

Under the SchellingDollar there are two coins, one pegged to the dollar and one volatile and a central “oracle” that imposes positive and negative interest rates on the stable coin to maintain price parity with the dollar.

A nice thing about positive interest rate is that it distributes new money evenly to all participants without any wealth reallocation. Unfortunately, a negative interest rate also exists. From the perspective of someone holding a coin, positive and negative interest rate changes are identical to price volatility.

From an economic point of view are people really any better or worse off if they have 100 tokens worth $1 or 1 token worth $100? If you are going to uniformly issue or revoke tokens to maintain price parity then we haven’t really solved anything other than saving merchants the hassle of changing their prices. Something they will probably be doing anyway as all goods and services are constantly changing in value.

Unlimited Conversion Issue

Both the SchellingDollar and Seignorage Shares approach allow users to convert between stable-coins and volatile-coins at an exchange rate provided by market oracles. The problem is that an exchange rate is based upon the market price on some external exchange. Everyone knows that if you attempt to sell at the market price you can only liquidate a small amount before the price starts falling. The more you attempt to liquidate the more “slippage” you get in the price and the end result is that you can never value your assets at the market price unless your quantity is a very small percentage of the daily trading volume. Any approach that provides unlimited liquidity at a fixed price is vulnerable to market manipulation attacks.

Principles Matter

When designing BitShares I started from principles rather than equations. These principles are fundamental to knowing whether or not a proposed solution was viable and sustainable. Here is a short list:

- No Price Fixing

- Only Voluntary Trades

- No Socialization of Risks with Centralization of Rewards

- No Fractional Reserves

Price fixing results in either shortages or gluts. Anytime you fix a price in one area, prices in other areas adjust to counteract your attempted manipulation. Voluntary trades are key to value discovery, if two parties do not agree on the price then the result is price fixing. Socialization of risks is a moral hazard when risks are separated from rewards. This is creates a “heads I win”, “tails you lose” situation and results in an unstable market environment where there is a guaranteed bet. Fractional reserves occurs anytime an IOU is created without collateral of greater value. This is the foundation of a Ponzi scheme where all IOUs cannot be redeemed and the basis of our modern banking system. If collateral is of a different asset than the IOU then it must be worth sufficiently more than the IOU to handle any conceivable volatility of the collateral and the IOU must be callable.

You will find that most systems violate one or more of these principles multiple times. Even BitShares is unable to completely adhere to all principles to the degree that we would like. We have many constants in the code that are hard coded (block size, asset registration fee, etc) that are a form of price fixing. Not all short positions have equal collateral yet all long positions are fungible and in times of very high volatility it is theoretically possible to end up with under-collateralized BitAssets.

All of that said, we do adhere to these principles where they matter the most: establishing the peg through voluntary trades at user specified prices. Rather than socialize the creation (shorting) of a BitAsset IOU, the risk and reward are entirely in the hands of individual speculators. Rather than fixing a conversion price, all BitAssets are only redeemable in an open market and our collateral requirements are far in excess of any plausible volatility.

Pegging to Fiat Currencies is Not Price Stability

A silent assumption of both SchellingDollar, Seignorage Shares, and Nubits is that pegging to the dollar achieves a stable crypto-currency. All that really does is strengthen the ability of the FED to steal your crypto-wealth by inflation. One day the dollar will have a massive revaluation due to the 3x growth in supply over the past several years. When that day comes you will find that none of these systems really offers price stability. In fact, according to shadowstats.com you are losing about 5% per year on your stable currency.

Predictable vs Stable

It seems to me that what people really want from a “stable” crypto-currency is reduced volatility. They want a unit of account that doesn’t have any meaningful capital gains or losses for tax purposes. They want to have a somewhat reliable ability to predict the future value of a token. For these people, price stability really means price predictability within some tolerance level. A willingness to accept a 5% loss per year by holding dollars demonstrates that predictability is more important than stability.

Predictability is critical for an economy to function because it impacts the ability of business men to reliably generate a profit or loss. The larger the market and the more widely accepted the currency the more predictable its value becomes. We have observed this process with Bitcoin on a small scale. As it has gone from pennies to hundreds of dollars we have seen that the day to day volatility has reduced as more people can reliably transfer larger quantities without slippage over short periods of time. If Bitcoin were to ever reach the scale of the dollar (or any reasonably large national currency) then you would see its valuation become as predictable as the dollar, complete with a 5+% monetary inflation rate.

The Gold or Silver Standard

Gold and Silver have historically been used as money and are the only forms of currency to retain any value at all over centuries. Today their price is as volatile as Bitcoin, but 100+ years ago their purchasing power was stable and growing whenever mining production was slow. This was because the industrial revolution was massively increasing the productivity of the average man at a rate in excess of new gold / silver discoveries.

The Ideal Money

If we think about the “ideal money” it would be widely accepted with 0% growth in supply. Being universally accepted it would have high predictability in purchasing power. Being fixed in supply, its value would predictably grow at the same rate as the economy in general. The more wealth that was produced the higher the value of money would become. Anyone could earn a very healthy, risk-free, return on their savings by simply holding them in their mattress. The rate of return would be equal to the average rate of return of all businesses in the economy.

Investors would be speculating on whether or not a new business opportunity would produce more value than average or not. When a business spends money it must expect a rate of return on that money higher than the rate of growth in the economy, otherwise they will lose purchasing power relative to simply holding the money. This is in stark contrast to todays investment environment where people can have nominal profits but real losses. Today people pay taxes on “gains” that are purely imaginary, based entirely on the fall of the value of the dollar. Often times businesses will pay taxes on imaginary gains while simultaneously having real losses.

The Ideal Money would have high “price deflation” while simultaneously supporting the maximum possible economic growth. Contrary to popular opinion, “price deflation” is only a problem for debt-based money. With debt based money price deflation often means the collateral behind the debt is falling in value and that the borrowers will have a harder time earning the money required to pay off the debt. This results in system wide debt defaults as lenders start losing money and borrowers go bankrupt. This is the reason why there is so much propaganda demonizing “deflation” or “falling prices” and supporting “slow inflation”.

A normal person who has money in the bank is happy to see house prices, car prices, computer prices, and food prices fall. Walmart is always advertising “falling prices” because people want falling prices. The cognitive dissonance of those who fear “falling prices” (deflation) and yet like it when their favorite toys get cheaper is astounding and represents a logical inconstancy between what they know is better for them (lower prices) and what the powers that be tell them is best for society (rising prices).

Stable crypto-currencies are Impossible

The goal of stable currency is a misguided goal. Pursuit of it is destined to fail because it is incompatible with reality and the nature of individualized subjective value of everything. The real goal is the global acceptance of a fixed supply predictably appreciating currency. The challenge is how do we get from where we are today to global acceptance when the value of our crypto-currency is highly volatile.

Attempting to peg to the dollar like we do with BitUSD needs to be a stepping stone toward another store of value. In my opinion, gold and silver, should be physical money and a crypto-currency should attempt to peg to gold and silver. In this way we can free all of society from the centralized control of fiat currency issuers and keep inflation limited to what gold and silver miners can produce. Their cost of production is constantly rising as the easily accessible supplies are mined. With gold and silver being the standard society can have a physically decentralized money and a digital representation of it.

The Superiority of BitShares Approach

With BitShares we simultaneously support many different BitAssets which are pegged to real world counter parts. This goes far beyond simply creating an alternative currency, it creates a decentralized, mostly trust free, fully collateralized lending platform for almost every possible commodity. With BitUSD and BitGOLD you have an “IOU” collateralized by 3x its value and thus a very low risk of default, especially as the system grows. Unlike the other “pegging” systems, BitAssets have a positive return proportional to the expected growth in the value of BTS relative to the value of the pegged asset. In time BTS will become the reserve currency and will ultimately become the fixed supply, counter-party-free, highly predictable, constantly growing ideal money. Between now and global acceptance of BitShares you can expect a highly volatile valuation of BTS similar to Bitcoin.

Fortunately we have the ability to simulate the ideal currency today, on BitShares. The ideal currency should have steadily predictable increases in value equal to the average productivity of society. A BitAsset can be created that automatically grows in value with an inflation index. Granted, this BitAsset could only be created so long as there are people willing to speculate that BitShares will grow faster than the economy as a whole, but this should not be a problem once the technology is mature and easy to use.

Conclusion

All attempts at creating a “stable currency” that neither grows nor falls in value are fundamentally flawed regardless of design because they are built to on a flawed requirement. All attempts at pegging a crypto-currency to a fiat currency are flawed if they violate the core principles of no price fixing, only voluntary trade, no socialized risk with centralized profits, and over 100% reserve backing. Only BitShares is compatible with these principles, invest accordingly.

Recommended by Bytemaster

(see more...)